Sponsored By

Good morning. Calgary native Rory Linkletter broke the Canadian half-marathon record over the weekend, running a race in Houston in just 59 minutes and 49 seconds. It’s the second time he’s claimed the record, and the first time a Canadian has cracked the 1-hour mark.

We can’t confirm, but it may also be a record for the fastest New Year's resolution ever completed.

Today’s reading time is 6 minutes.

MARKETS

| ▲ | TSX |

32,612.93 |

+1.22% |

|

| ▲ | S&P 500 |

6,966.28 |

+0.93% |

|

| ▲ | DOW JONES |

49,504.07 |

+1.08% |

|

| ▲ | NASDAQ |

23,671.35 |

+1.18% |

|

| ▲ | GOLD |

4,500.9 |

+0.90% |

|

| ▲ | OIL |

59.12 |

+2.35% |

|

| ▼ | CAD/USD |

0.72 |

-0.29% |

|

| ▲ | BTC/USD |

90,514.93 |

+0.07% |

Earnings to watch: The major U.S. banks report this week, with J.P. Morgan kicking things off on Tuesday. On this side of the border, the embattled media business Corus Entertainment will report its earnings on Wednesday.

BUSINESS

Canadian venture fundraising cratered last year

Consider taking a moment today to check in on any venture capitalists in your life, because (in Canada, at least) there’s a good chance they just went through a rough year.

What happened: Canadian VCs raised just $2.1 billion last year, according to a new RBCx report, the worst showing since 2016 and well below the average of $3.1 billion.

Emerging managers — defined in the report as those that have raised three or fewer funds — are struggling the most to find fresh capital, raising only $249 million last year. That amounted to just 12% of all venture capital raised.

Why it matters: Less capital means fewer cheques for Canadian startups, not exactly what the country needs at a time when the economy could use a stiff dose of innovation to offset the effects of the U.S. trade fight.

Why it’s happening: The downturn is likely the result of a few factors, including a hangover from the pandemic-era tech boom when interest rates were near-zero and cash was flowing freely.

The flight of capital away from emerging managers to established ones also suggests investors are looking for safer, more conservative bets and entrusting their money with managers they know and trust — about what you’d expect in a more uncertain economic environment.

What’s next: Today’s startups are tomorrow’s world-beating companies; today’s emerging managers are the investors who will, five or 10 years from now, fund the next generation of promising startups. If that pipeline dries up, Canada will be feeling the effects for years to come.—TS

BIG PICTURE

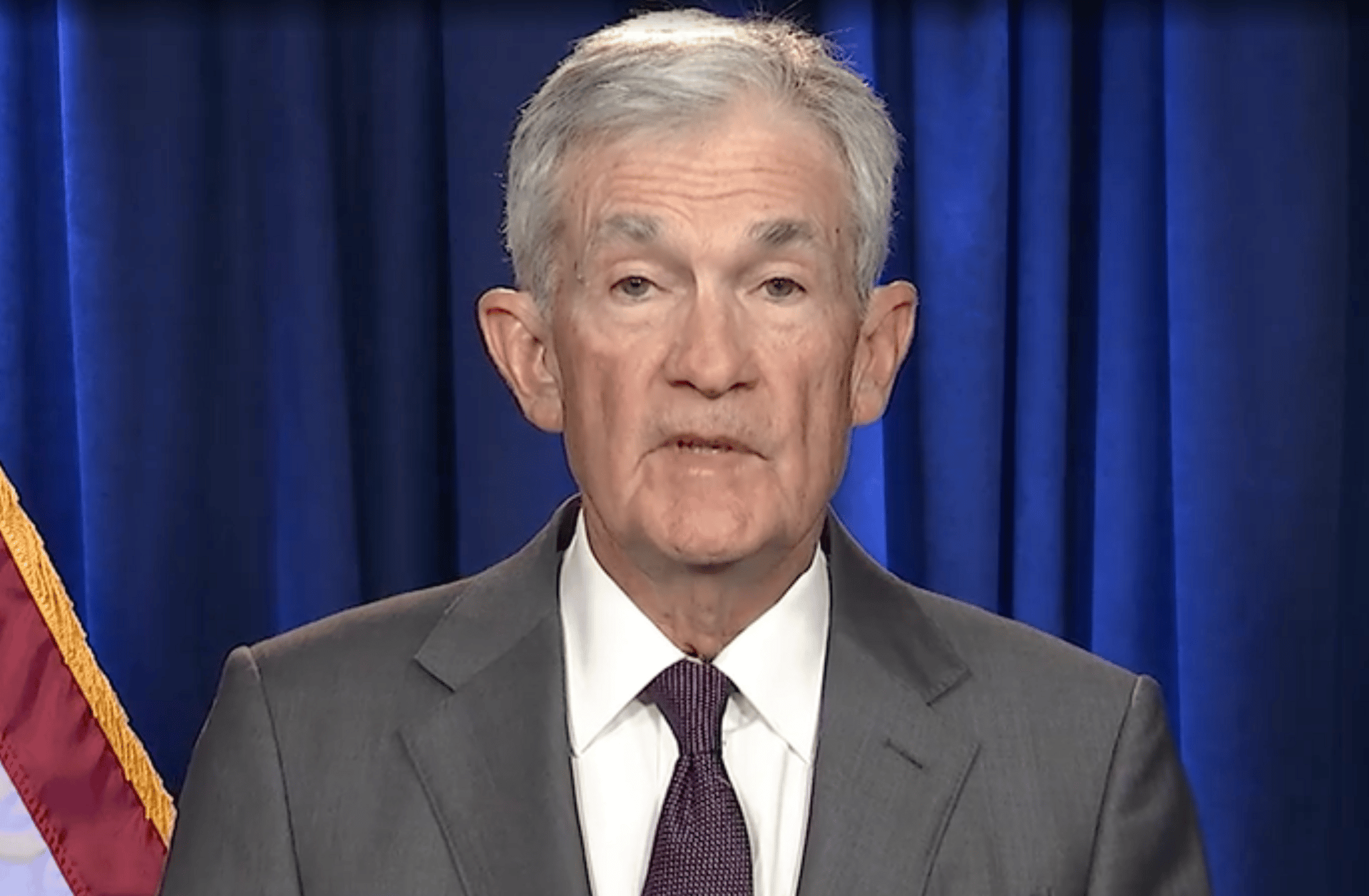

Source: Video screenshot / Federal Reserve

Trump is threatening Jerome Powell with prosecution. Federal Reserve chair Jerome Powell said the Trump administration had threatened him with criminal prosecution over testimony he gave regarding a Fed building renovation project. Powell called the move a “pretext” to pressure him to cut interest rates. “The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President,” Powell said. (Reuters)

Trump is also threatening Cuba. In a series of posts on Sunday, the President threatened Cuba and demanded that they negotiate with the U.S. “before it’s too late,” though he didn’t specify what exactly he’s demanding. (Guardian)

SSENSE’s original founders are buying the company back. Co-founders (and brothers) Rami Atallah, Bassel Atallah and Firas Atallah are buying back their Montreal-based retailer just months after it filed for creditor protection. The high-end fashion brand has laid off around a third of its workforce in the last few months. (CTV News)

Elon Musk is planning to make X’s algorithm open source. The platform's code will reportedly be made public in seven days, including parts of the model that decide what content is recommended to users. The algorithm and X’s chatbot Grok have come under fire lately for allowing users to generate sexually explicit deepfakes. (Bloomberg)

Iran is threatening to strike U.S. military bases. As the Islamic Republic government continues its crackdown on mass protests, Tehran says it will strike U.S. bases in the Middle East if the U.S. follows through on its threats to intervene in the conflict. According to a new report, over 500 people have been killed in Iran over the last two weeks of protests. (Wall Street Journal)

GameStop is shutting down over 400 stores. The video game retailer is closing roughly a quarter of its U.S. stores. Queue another meme stock rally. (Polygon)

SPONSORED BY DEGROOTE SCHOOL OF BUSINESS

The business world doesn't wait for anyone to catch up.

Technology shifts overnight. Industries transform in months. The skills that got you here won't necessarily get you there. That's why DeGroote School of Business built programs for every stage of your career, because learning shouldn't stop when circumstances change.

Whether you're fresh out of undergrad, mid-career and hungry for advancement, or a seasoned executive eyeing the C-suite, DeGroote has a program designed for where you are right now.

What makes DeGroote different:

Future-proof curriculum blending essential business fundamentals with hands-on experiential learning

Critical thinking focus that prepares you for problems that don't exist yet

Human-centered approach balancing tech skills with creativity, communication, and ethical leadership

Flexible formats designed for working professionals and full-time students alike

At DeGroote, you're not just earning credentials. You're becoming an agent of positive change, equipped to lead with ambition, think ethically, and contribute meaningfully to the world around you.

LOOKOUT

What’s happening this week

Source: @markjcarney / X.

🇨🇳 Carney goes to China. Prime Minister Mark Carney will be in China this week, where he’s expected to meet with President Xi Jinping and other Chinese leaders. It’s the first visit of a Canadian prime minister to China since 2017, and could mark a thawing of relations as Canada looks to diversify its export markets away from the U.S. One of the big issues to watch is Canadian tariffs on Chinese EVs, and China’s retaliatory tariffs on Canadian food products like pork and canola. This may be an opportune time for the trip, as the U.S. intervention in Venezuela has China looking for new sources of oil.

🧑⚖️ The Supreme Court may rule on tariffs. The U.S. Supreme Court is expected to issue a batch of rulings on Wednesday, and its decision on a case concerning the legality of Donald Trump’s tariffs imposed through emergency economic powers may be among them. The ruling would not impact sector-specific tariffs, like those the U.S. has levied on Canadian steel and aluminum. If the court doesn’t rule on tariffs this week, it’s unlikely it will issue a decision earlier than late February.

🇺🇸 Final U.S. inflation print before rate decision. The U.S. Consumer Price Index report lands tomorrow and will be an important data point for the Fed’s interest rate decision at the end of the month. Markets still aren’t pricing in a rate cut until later in the year, but the U.S. job market has been weakening, and cooler-than-expected inflation could nudge the central bank in a more dovish direction.

What else is on our radar: U.S. Secretary of State Marco Rubio is expected to meet with officials from Greenland and Denmark this week, Portugal is having its presidential election, and there will be a court hearing for Tyler Robinson, charged with murder in the shooting of Charlie Kirk.

TECH

Canadian company wins a mini space race

Source: Kepler.

It may sound like the log line for a low-budget sci-fi movie, but a Canadian company just launched a bunch of high-tech lasers into space.

What happened: Toronto-based space startup Kepler launched 10 of its low Earth orbit optical satellites into space yesterday, marking a major milestone toward building one of the world’s first commercially operational laser-based satellite networks.

Kepler, which was founded by a group of three University of Toronto classmates in 2015, became Canada’s largest satellite operator just a few years later with its first launch in 2021.

Its model is similar to how cloud computing works on Earth. Instead of building their own infrastructure, customers can use Kepler’s network to collect, store, and relay data without having to operate their own satellites.

Why it matters: The lasers that connect Kepler’s satellites allow data to be sent back home (and to other spaceborn craft) immediately, meaning they no longer have to wait to pass over a ground station on Earth to transmit information, a delay that can take hours.

In practical terms, that can mean faster wildfire and flood detection, quicker disaster response, and better military intelligence.

Bottom line: It’s a big deal — and a win for the country’s space industry — that a relatively small Canadian company is now going head-to-head with heavy hitters working on similar systems, like SpaceX and Amazon.—LA

ONE BIG NUMBER

🛍️ ~$1 billion. Aritzia’s sales last quarter, a record high for the Vancouver-based retailer. The company says its banner year was driven largely by the success of its U.S. expansion and mobile app launch, which has been downloaded 1.4 million times. Aritzia has now beaten earnings expectations in 10 straight quarters.

PEAK PICKS

Stock Advisor Canada released their 5 best picks to buy in January. Get one of our Best Buys Now picks in your inbox for free today.*

Meet the Canadian ice expert tasked with making Milan’s troubled Olympic hockey rink playable.

Tips for keeping your devices clean, according to an expert.

An affordable guide to one of the world’s most expensive destinations (Wall Street Journal, paywalled).

How to bring wilted veggies back to life.

What it’s like trying to get a robot to do your laundry.

Watch: The first person to climb up and then ski down Mount Everest.

*This is sponsored content.

GAMES

Welcome back to the work week. Here’s your mini-crossword and today’s sudoku to start the day.

And for our intrepid band of puzzle testers, here’s today’s bonus mini.